August 14, 2025

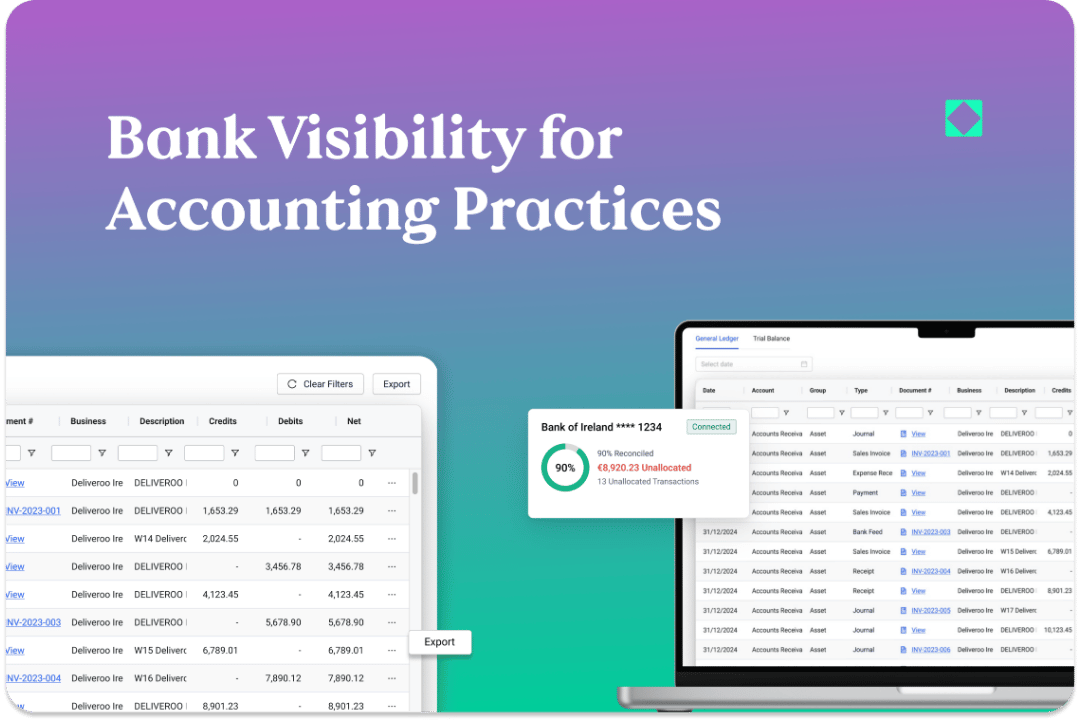

Introducing Bank Visibility for Accounting Practices

Ask any accounting firm what keeps them up at night, and bank reconciliation visibility will likely top the list. You're constantly juggling multiple client accounts, trying to figure out what's been allocated, what needs attention, and whether your data is even current.

It's exhausting. And frankly, it shouldn't be this hard.

That's why we're excited to introduce Bank Visibility, our latest feature designed specifically for accounting practices. This isn't just another financial reporting tool. It's complete transparency across every client's bank reconciliation status, available instantly whenever you need it.

What Is Bank Visibility?

Bank Visibility is our new bookkeeping feature that gives you up-to-date insight into reconciliation status across all your clients' bank accounts. Think of it as your command centre for understanding what's happening with client finances right now.

When you log into your Outmin portal, you'll immediately see a summary of all client bank accounts for the selected period. For each account, you can see reconciliation percentages, unallocated transaction counts and values, connection status, and last sync dates.

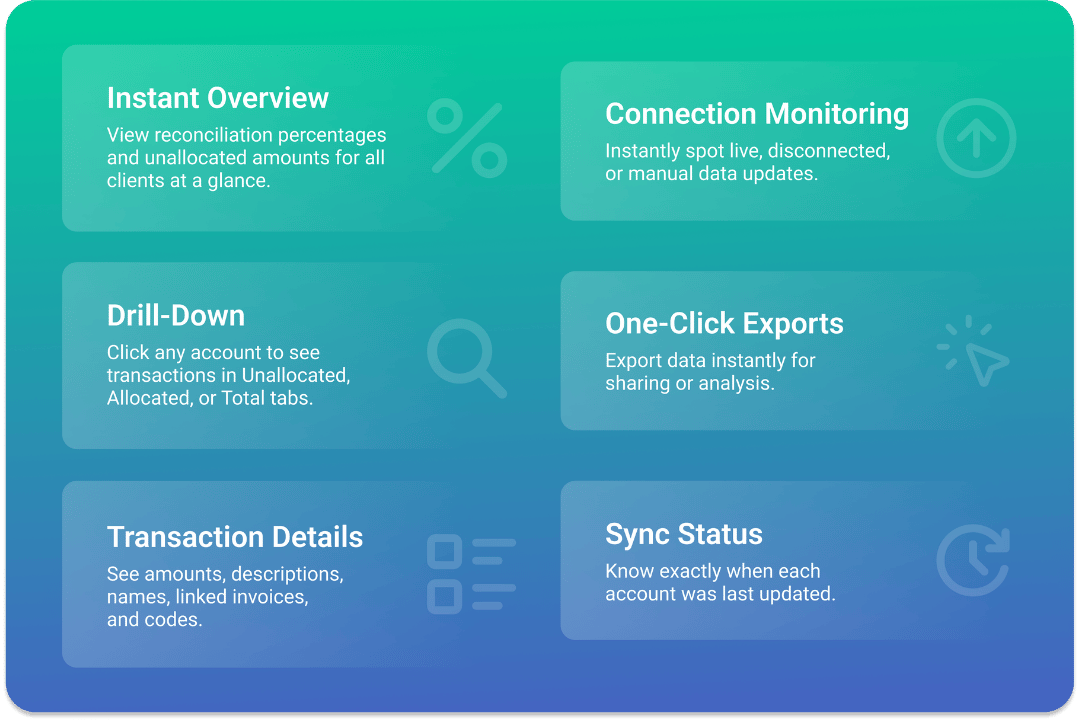

Here's what you get:

- Instant Overview: See reconciliation percentages and unallocated amounts across all client accounts at a glance. No more wondering which clients need attention or manually checking individual accounts.

- Drill-Down Capabilities: Click into any bank account to see detailed transaction views. Switch between three tabs: Unallocated (what still needs work), Allocated (what's been reconciled with full details), and Total (complete transaction history).

- Connection Monitoring: Always know whether data is live, disconnected, or manually updated. If a client's bank connection drops, you'll see it immediately and can take action.

- Full Transaction Details: Every transaction shows payment amounts, descriptions, supplier or customer names, linked invoices, and nominal codes. Everything you need to understand what happened and when.

- One-Click Exports: Generate data exports instantly. Whether you need to share information with clients or pull data for analysis, everything is exportable with a single click.

- Current Sync Status: See exactly when each account was last updated, so you always know how current your information is.

How Bank Visibility Works

Bank Visibility leverages our existing bank feed integration to provide you with current reconciliation data. We connect to your clients' bank accounts through Plaid, a secure, regulated third-party provider, and our system processes and categorises transactions through daily processing cycles.

Our AI models handle the initial categorisation, but everything is reviewed by qualified accountants to ensure accuracy. This combination of automated processing and human oversight means you get reliable, trustworthy data every time.

The system processes data daily and performs full reconciliation monthly, so your reconciliation status reflects the most recent processing cycles. When you check a client's bank visibility, you're seeing data that's been processed and verified according to our regular schedule.

Who Is Bank Visibility For?

Bank Visibility is available to all accounting practices using our portal at no additional cost. If you're already working with us, simply log into your portal and you'll find this feature ready to use.

This feature is particularly valuable for practices managing multiple clients with complex banking setups. Whether you're dealing with single-entity clients or multi-location operations with multiple bank accounts, Bank Visibility scales to match your needs.

Since Bank Visibility is part of our new portal experience, it works seamlessly with our existing General Ledger and Trial Balance features. This integration means you have a complete picture of your clients' financial status in one place.

Built for How You Actually Work

At Outmin, we've always focused on solving real problems that accounting practices face every day. Bank Visibility came directly from conversations with our accounting partners, who told us they needed better ways to monitor reconciliation status across their client base.

"Visibility has always been one of the biggest challenges for practices," says David Kelleher, our co-founder. "You're managing dozens of clients, each with multiple bank accounts, and you need to know instantly where things stand. Bank Visibility gives you that overview without having to dig through individual client files or wait for reports."

Every aspect of the interface is designed around the workflows and information needs of accounting professionals. You can quickly assess which clients need attention, dive deep into specific issues, and export data in the formats you actually use.

Why Bank Visibility Matters

Reconciliation visibility isn't just about staying organised. It directly impacts your ability to serve clients effectively and manage your practice efficiently. When you can see reconciliation status at a glance, you can prioritise client reviews more effectively, spot potential issues early, and provide better service to your clients.

Many practices spend significant time each week just figuring out where things stand with client reconciliations. Bank Visibility eliminates that overhead entirely. Instead of spending time discovering what's been processed, you can focus on client communication and strategic advice.

This visibility also improves your client relationships. When clients ask about their bank reconciliation status, you have immediate, accurate answers. No more "let me check and get back to you" conversations. You can see exactly what's been processed and what's outstanding, with full transaction details to back up your responses.

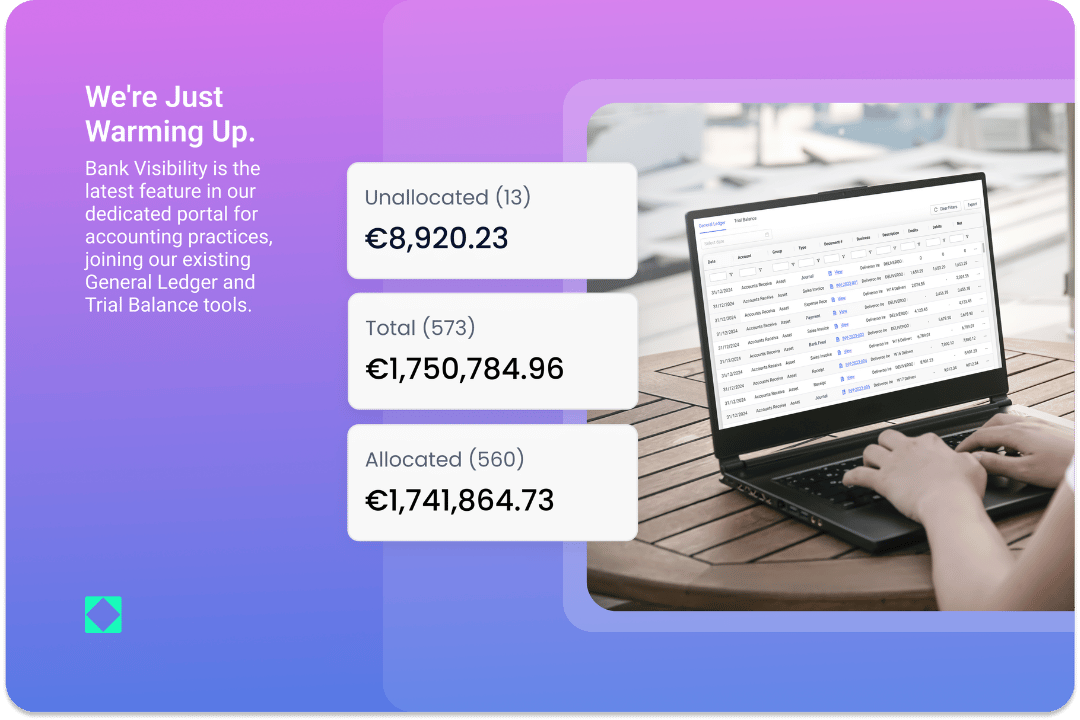

The Portal Is Just Getting Started

Bank Visibility is the latest feature in our dedicated portal for accounting practices, joining our existing General Ledger and Trial Balance tools. But we're just warming up.

We're building this portal specifically around the visibility that benefits accounting practices most. Bank reconciliation status was the obvious place to start, but it's not the only area where practices are flying blind. We hear the same challenges over and over: you need clearer insight into what's happening across all aspects of your clients' books.

The portal is designed to give you that complete picture. Every feature we add focuses on the same core principle: instant visibility into the information you need to manage your clients effectively.

We're excited about what Bank Visibility brings to your practice today, and we're even more excited about the additional visibility features coming soon. This is our commitment to transforming how accounting practices stay informed and in control.

Get Started Today

If you're already using our portal, log in and explore Bank Visibility. It's available immediately for all your clients, with no setup required on your end.

We built this feature based on feedback from practices like yours, and your continued input helps us make it even better. Try it out, see how it fits into your workflows, and let us know what you think.

Not using Outmin yet? We'd love to show you how Outmin works and how it can transform your practice operations. Book a demo here and see what modern practice management looks like.