Outmin Vs Xero

Outmin Vs Xero: Quick comparison overview

Integration ecosystem: very different philosophies

Making the decision: 5 key questions to ask when comparing Outmin vs Xero

The bottom line: two different solutions for different needs

Ready to Move Beyond Manual Bookkeeping?

Frequently Asked Questions

vs

Outmin vs Xero: The Xero Alternative Guide 2025

Xero is software. It still needs you — or a bookkeeper — to push the buttons. Outmin is different: an AI Bookkeeper that does the work for you. If you’re looking to cut the stack (Xero + Dext + staff) and get real bookkeeping done automatically, this is where the comparison starts.

Outmin Vs Xero: Quick comparison overview

Features

Xero

System Type

AI-native bookkeeping system with human oversight

Cloud-based accounting software tool

Who It’s For

Small businesses + large businesses & accounting firms that want to eliminate manual bookkeeping

Business owners & accountants who want a digital toolkit

Key Strength

Fully automates daily bookkeeping with integrated reconciliation and human QA

Feature-rich accounting software for manual bookkeeping workflows

Manual Data Entry

80% eliminated via automation

Requires substantial manual input or add-ons like Dext

Bookkeeping Tasks

Done for you (by the system + team)

You or your staff must perform tasks inside the software

Real-Time Reporting

Yes, on demand – cash flow, P&L, income statement, trial balance, debtors & creditors

Yes, configurable reports (manual inputs required)

POS & Supplier Integration

Native ingestion for high-volume suppliers and POS feeds

Add-ons or third-party integrations required

App Marketplace

Not needed – it’s an all-in-one system

Yes, Xero App Store offers 100s of integrations

Pricing Model

Based on volume of documents processed

Flat monthly software subscription (add-ons extra)

Understanding the fundamental difference

Before diving into specific features and pricing, it's crucial to understand that Outmin vs Xero represents completely different accounting models. When business owners compare Outmin to Xero, they're often surprised to discover this isn't a comparison between two similar accounting software platforms.

It's the distinction between a traditional tool you manage yourself and a comprehensive service that manages your bookkeeping for you. Recognising this fundamental difference will help frame every other comparison point in this guide.

What Xero is: a powerful tool that still needs you

Xero online accounting software for your business connects you to your bank, accountant, bookkeeper, and other business apps. Founded in 2006, Xero has become a global leader in cloud-based accounting software, serving millions of users worldwide. It's designed as a comprehensive tool that gives you the capability to manage your finances, but you're still responsible for doing the work.

Xero's core philosophy: Give users accounting tools and let them handle their bookkeeping, with optional integrations to other services.

What Outmin is: an AI-native replacement system

This Xero competitor doesn't integrate the old guard: software and humans, it replaces them. Founded in 2020 in Dublin, Outmin represents a fundamentally different approach to business finances. Rather than providing tools for you to use, Outmin built a full-fledged digital bookkeeper that automates the manual processes that traditional software still requires humans to perform.

Outmin's core philosophy: Remove the burden of bookkeeping entirely through AI automation backed by expert human oversight.

Your time is worth more than bookkeeping

Turn hours of accounting work into minutes of oversight. We handle the grind while you focus on growth.

Show Me How

Features & Functionality

Before diving into specific features and pricing, it's crucial to understand that Outmin vs Xero represents completely different accounting models. When business owners compare Outmin to Xero, they're often surprised to discover this isn't a comparison between two similar accounting software platforms.

It's the distinction between a traditional tool you manage yourself and a comprehensive service that manages your bookkeeping for you. Recognising this fundamental difference will help frame every other comparison point in this guide.

Xero's feature set: comprehensive but manual

Xero provides an impressive array of accounting features:

Invoicing & Accounts Receivable

Create professional, customised online invoices quickly. Set up automated payment reminders, though you'll need to monitor payment status and follow up on overdue accounts manually

Bank Reconciliation

Xero automatically matches bank feed lines to existing transactions and asks for your approval. However, unmatched transactions require your review, and you'll need to investigate and resolve discrepancies yourself

Financial Reporting

Access to comprehensive reports including P&L, Balance Sheet, and Cash Flow statements, but interpreting the data and taking action based on insights remains your responsibility

Multi-currency Support

Handle international transactions (on higher-tier plans)

Payroll Management

Regional payroll features (often as add-ons)

Extensive Integrations

Xero integrates with several third-party applications, including CRM systems, eCommerce platforms and payment gateways

Dashboard & Analytics

Customisable dashboard displays cash flow, outstanding bills, bank balances, and key metrics. However, users find it "overwhelming" with poorly organised headings and cluttered visuals requiring manual interpretation

Mobile App

Basic admin and bookkeeping tasks like creating invoices, reconciling transactions, and uploading receipts. While functional, it requires active user input and has limited functionality compared to the desktop version

The Reality: While Xero has extensive features, you're responsible for inputting data, managing documents, chasing suppliers, and ensuring everything is reconciled correctly.

Outmin's feature set: full automation with expert oversight

Outmin approaches functionality differently. Instead of giving users tools to use, it performs the work automatically:

Smart Data Retrieval

AI bookkeeper connects directly to suppliers, bank accounts, and POS systems to pull in financial records before users even think about it

AI-Powered Document Processing

Advanced OCR scans documents with high accuracy, extracting all relevant details without manual data entry

Automatic Categorisation

AI bookkeeper learns how businesses categorise transactions, automatically tagging and sorting financial data based on established patterns

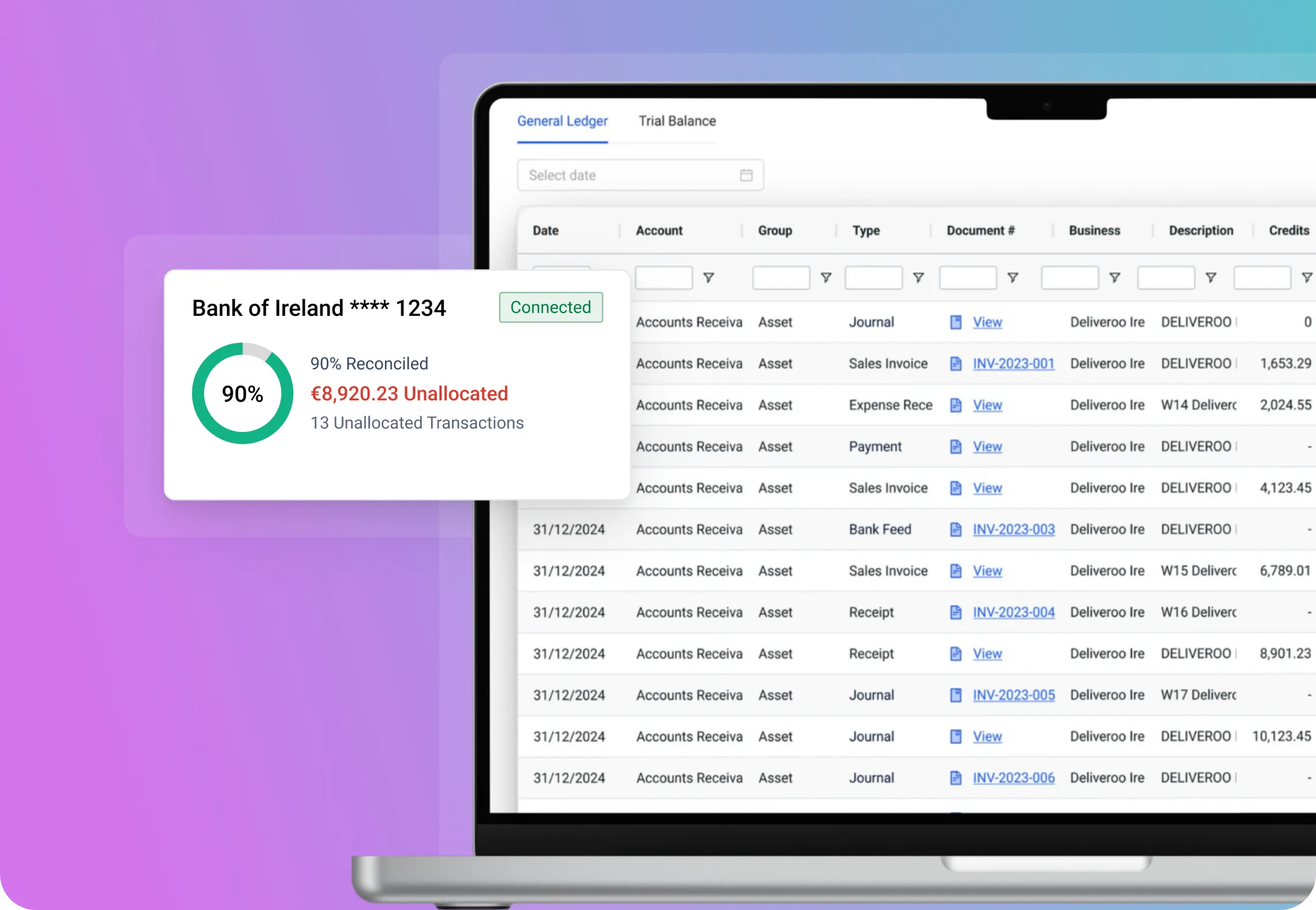

Intelligent Reconciliation

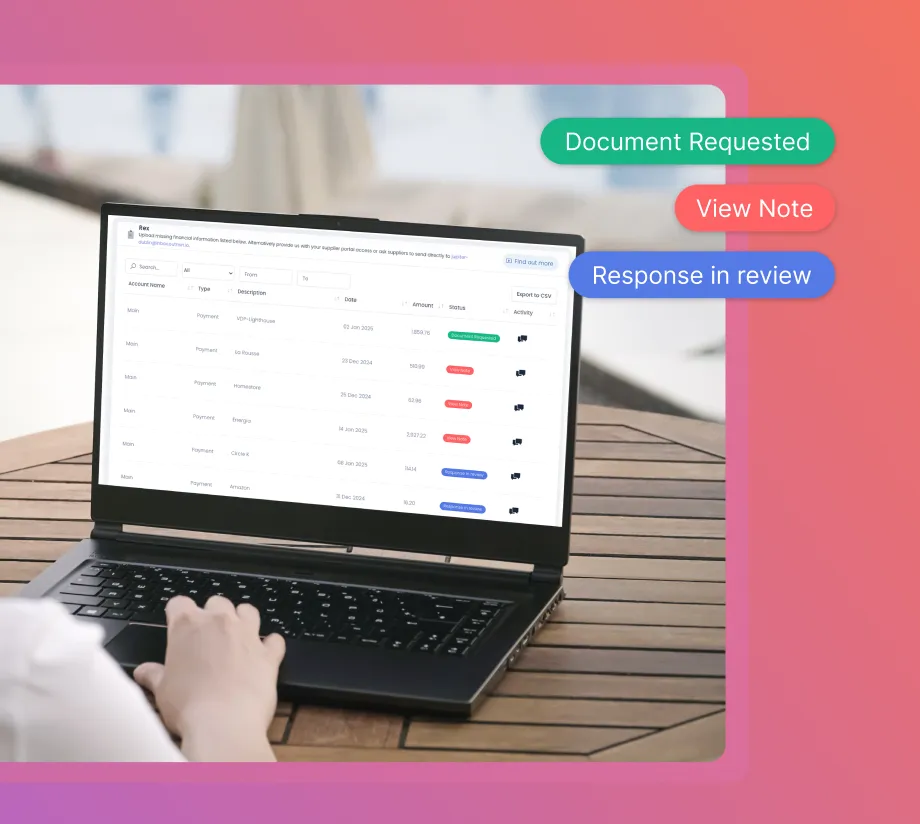

Accounts are reconciled automatically, with discrepancies flagged immediately for review

Anomaly Detection

The system automatically flags duplicate charges, missing invoices, and unexpected payments

Expert Human Oversight

All automated work is cross-checked by AI algorithms, professional accountants, and built-in anomaly detection systems

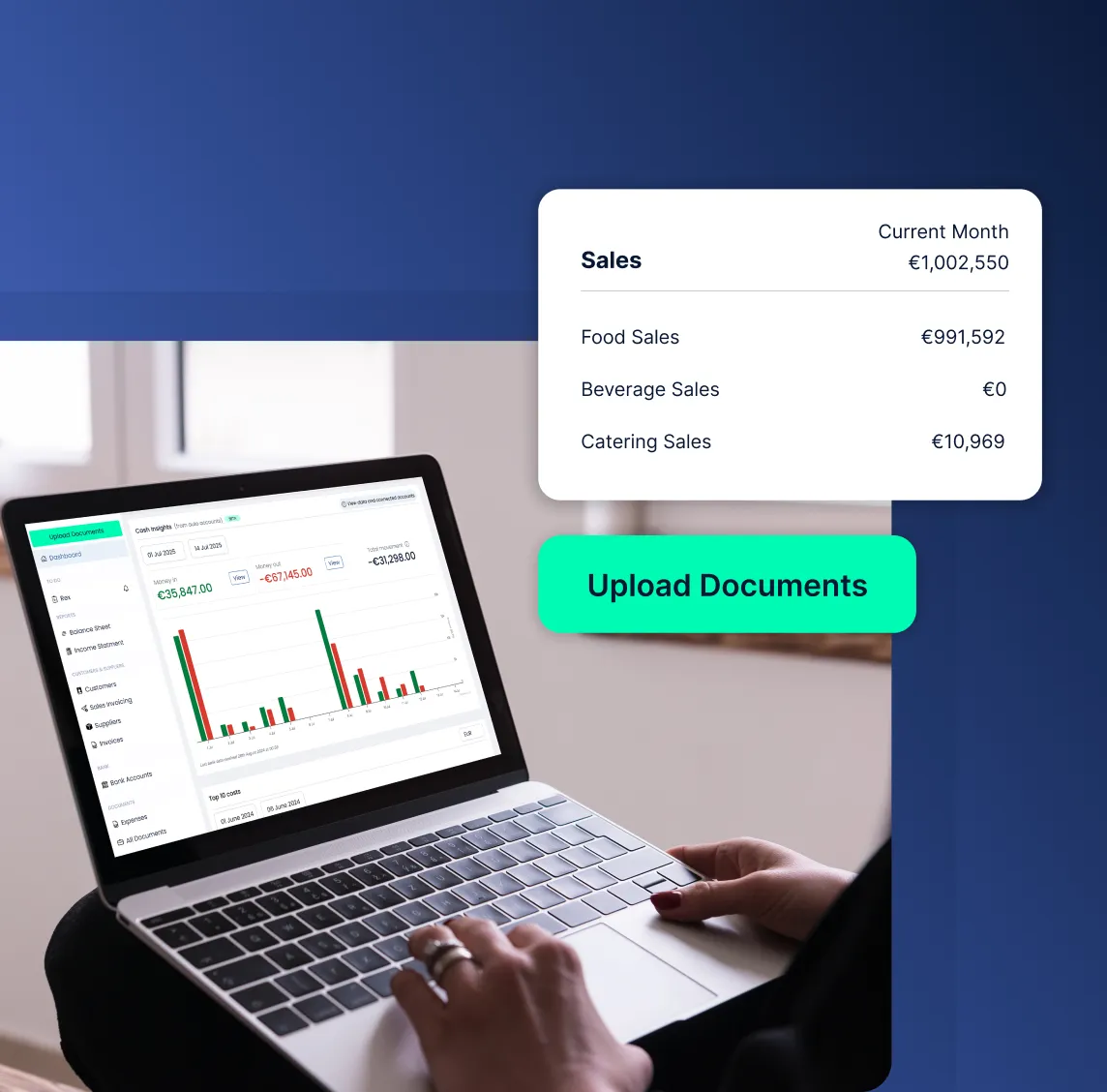

Zero-Touch Dashboard

Financial command centre providing clear, clutter-free visibility with mostly view-only access. Users can monitor cash flow, access reports, and manage locations effortlessly without manual data manipulation

Mobile App Integration

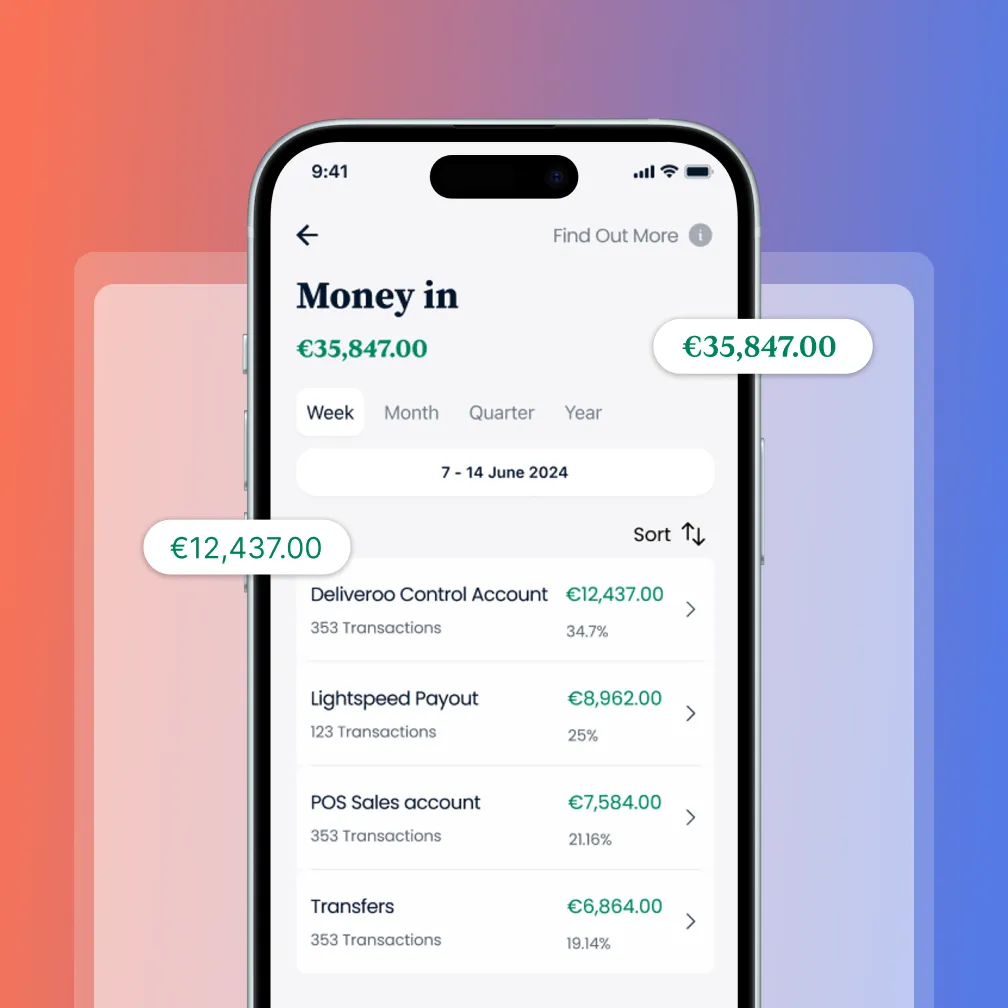

Upload documents effortlessly via photo capture, respond to Rex (AI assistant) requests instantly, and monitor cash flow with simple money-in/money-out reports. The app is designed for minimal input maximum insight

The Reality: Outmin processes months of transactions in minutes with zero manual effort while maintaining 98%+ precision through AI-driven classification combined with expert verification.

From chaos to clarity in a few days

Ditch the spreadsheets, the chasing, and the guesswork. Get clean books, daily updates, and total financial control.

Get My Demo

Integration ecosystem: very different philosophies

The integration approaches reveal fundamentally different visions for how businesses should manage their financial ecosystem.

Xero's ecosystem is its crown jewel, with over 1,000 third-party tool add-ons. This extensive marketplace allows businesses to connect everything from CRM systems to specialised industry software.

However, this approach requires users to research, select, configure, and maintain multiple integrations themselves. Each additional connection adds complexity to your financial workflow and requires ongoing management to ensure data flows correctly between systems.

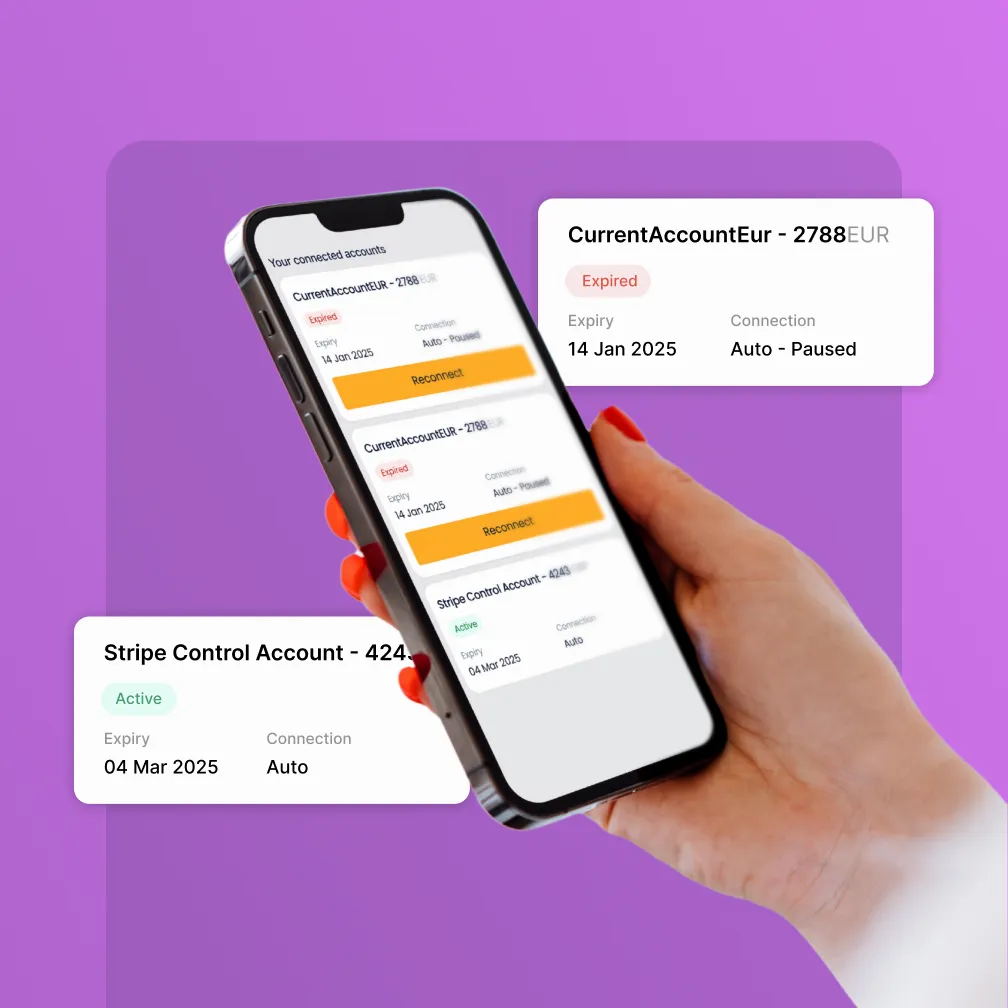

Outmin does not require users to set up or manage integrations. It takes a focused approach, connecting directly to the systems that matter for bookkeeping: banks, POS systems, supplier portals, and payroll data.

There is no need to install apps, configure settings, or monitor data flows. Financial information is pulled in automatically and processed without manual input. Unlike systems that require users to build custom workflows, this Xero alternative operates as a complete system of record from day one.

Ease of Use: DIY vs Zero-Touch

Comparing the "ease of use" between Outmin vs Xero is almost misleading. It's like comparing how easy it is to drive a car versus how easy it is to be a passenger. Outmin's platform is designed to be nearly read-only for users, while Xero requires active management and input to function effectively.

Xero: Mixed usability reviews

Outmin: A simplified user experience

Users generally praise Xero's clean interface and find the customisable dashboard helpful for quick financial insights. However, recent testing reveals a different story - while users appreciated specific features, some found the software "hard to use in general," with parts of the interface feeling outdated and some workflows being convoluted.

More importantly, even when the interface works well, it doesn't eliminate the substantial work required: users still need to upload and categorise documents, review bank reconciliation matches, chase suppliers for missing information, and interpret financial reports to take action.

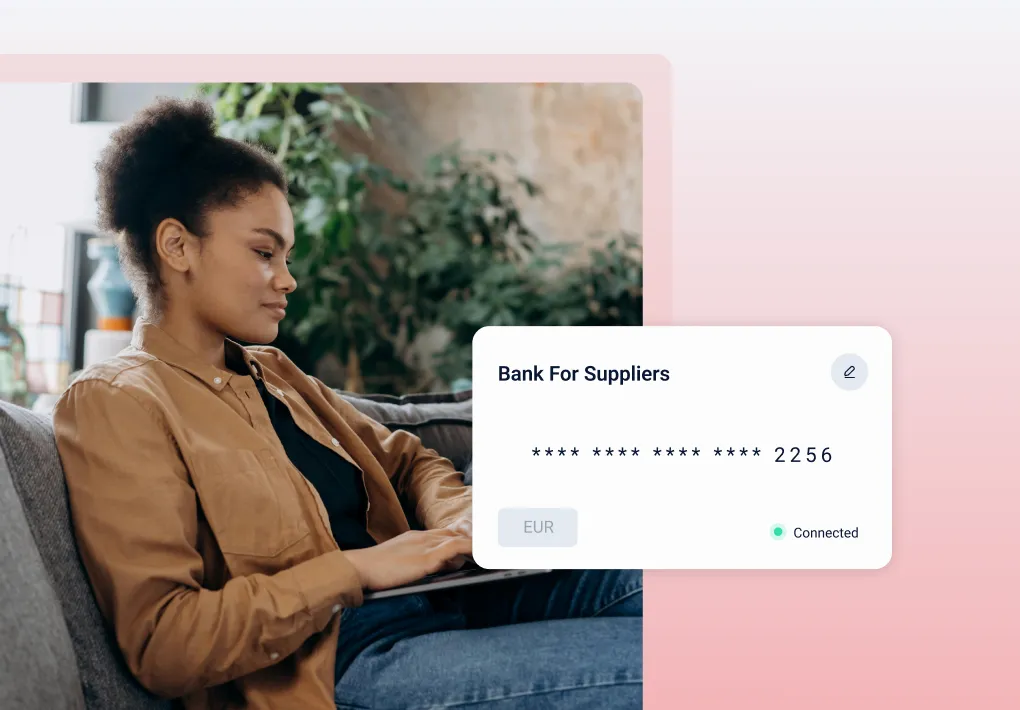

This best alternative to Xero stems from eliminating most user tasks entirely. Users primarily need to upload occasional one-off receipts, while the platform handles everything else automatically. The user-friendly interface is designed for simple monitoring rather than active management.

Checking reports, reviewing cash flow, and accessing financial data requires minimal interaction. Users can view their financial position without needing to input, categorise, or reconcile data. The system operates in the background, presenting users with ready-to-use information rather than tools they need to operate.

You don’t need to learn how to “do” bookkeeping on Outmin. That’s the whole point.

vs

The last bookkeeping system you’ll ever need

One platform. Zero manual work. 100% accuracy. It’s time to upgrade.

Book a Demo Today

Pricing: don’t compare Xero alone

This is where direct comparisons get tricky and often misleading.

When business owners compare Outmin to Xero, they discover that comparing Outmin's pricing to Xero's monthly subscription is like comparing the cost of a fully-managed restaurant to the price of a cookbook. They serve completely different purposes.

Xero's pricing structure (2025)

Outmin’s all-inclusive pricing

UK pricing:

From 1 September 2025, the price of Xero will increase in the UK. Here are the plans and prices:

Ignite (€16/month): Basic plan for sole traders and new businesses. Limited to 20 invoices and 10 bills, includes essential features like bank reconciliation and VAT returns.

Grow (€37/month): For growing small businesses. Removes invoice/bill limits, adds expense claims for 5 users, and includes payroll for 5 people.

Comprehensive (€50/month): For established businesses. Adds multi-currency support and payroll for up to 10 people.

Ultimate (€65/month): Most advanced plan. Includes project tracking for 10 users, advanced analytics, and comprehensive features for larger operations.

The hidden costs of the Xero approach

What Xero's pricing doesn't include:

Document Management: Dext or similar service (~€20-40/month)

Human Bookkeeping: €25-75/hour for manual work

Accountancy Support: €150-300/hour for professional guidance

Time Investment: Your own time managing the system

Error Correction: Additional costs when mistakes happen

This means the true cost of a Xero setup can range from approximately €700-3,000+/month when including all necessary services and time investment, compared to Xero's advertised €16-65/month software subscription.

Large and small businesses alike often find that this Xero competitor delivers far better value when considering total cost of ownership.

Outmin charges based on the number of purchase invoices processed. That sets a fixed monthly fee for the business. Starting from €399/month, Outmin replaces your entire bookkeeping stack, meaning businesses typically save around 40% to 70% on their bookkeeping setup.

Every Outmin plan includes:

AI Bookkeeper – Continuous automated processing that handles invoice management, bank reconciliation, VAT preparation, and transaction categorisation without manual intervention

Accounting Manager – Dedicated expert who oversees the AI system, ensures data accuracy, resolves discrepancies, and provides professional support when needed

Outmin Platform – Dashboard providing real-time financial data with daily report updates, search functionality, and data export capabilities backed by verified transaction records

The transparent pricing model means no surprise costs for additional hours, no separate software subscriptions to manage, and no need to coordinate between multiple service providers.

Stop paying for software you still have to run

Replace your entire bookkeeping stack with one intelligent solution—AI + humans, done-for-you.

Book My Free Demo

Scalability and Growth Support

Xero's growth limitations

While Xero offers unlimited users and can technically scale with growing businesses, the manual work required creates bottlenecks:

More transactions = more manual processing time

Additional locations = more complexity to manage

Growth increases the risk of errors without additional oversight

Outmin's scalable architecture

Outmin's AI-native system scales automatically without requiring additional staff or increased management overhead. This Xero alternative’s platform architecture supports:

Processing capacity that scales automatically with transaction volume

Multi-location support built into the core system

Consistent service levels regardless of business size

Expert support that scales with client needs

Customer support & experience

Customer support approaches reveal fundamental differences in how business owners receive help. While Xero provides traditional software support with documented accessibility issues, Outmin operates as an ongoing service partnership with dedicated experts and proactive assistance.

Xero's support model

Xero provides traditional software support through:

Online knowledge base and tutorials

Community forums

Email contact forms

No direct phone support

User feedback shows ongoing problems with Xero's customer support. Users struggle to find the support portal within the software, and response times are often slow enough that people solve their own problems before getting help. Many users are frustrated by the lack of phone support, especially when they need quick help with urgent issues.

Outmin's partnership approach

Rather than providing support for software, Outmin provides ongoing partnership, one of the reasons why many businesses consider it the best alternative to Xero:

Dedicated Customer Success Manager: Personal point of contact

Multiple support channels, including email and embedded messaging in the platform

Clients report very quick response times, usually within 24 hours

Proactive outreach when documents or clarifications are needed

Expert accountants overseeing outputs, not just support reps

When Outmin vs Xero Makes Sense

Xero if...

Outmin if...

You prefer hands-on control over your bookkeeping process

You have accounting expertise and plenty of time to manage the system

Your business has low transaction volumes

You're comfortable with DIY software management

Budget constraints require the lowest possible monthly software cost (ignoring total cost of ownership)

You want bookkeeping completely off your plate: Focus on customers and business growth while bookkeeping is handled automatically

You value your time and recognise time = money: The time spent on manual bookkeeping tasks could be better invested in growing your business

You need expert-level accuracy without hiring experts: Professional oversight ensures compliance without internal accounting staff

You're scaling rapidly and need bookkeeping that scales automatically with transaction volume

You operate in hospitality, retail, or manufacturing where Outmin has specialised experience

vs

5 key questions when comparing Outmin vs Xero

1.

Do you want to manage bookkeeping or eliminate it?

Manage it → Xero

Eliminate it → Outmin

2.

Is your time worth more than potential software savings?

Software cost matters most → Xero

Time is more valuable → Outmin

3.

Do you have internal accounting expertise?

Yes, we can manage it → Xero

No, we need expert help → Outmin

4.

How important is scalability without hiring?

We can hire as needed → Xero

We need to scale without headcount → Outmin

5.

Do you prefer control or convenience?

Control over every detail → Xero

Convenience and results → Outmin

The bottom line: two different solutions for different needs

Outmin vs Xero isn't really a comparison between two accounting software platforms. It's a choice between two fundamentally different approaches to business finance management.

Xero remains a good choice for businesses that want powerful, flexible accounting software and have the time, expertise, and resources to manage their bookkeeping processes. It's particularly strong for companies that need extensive customisation or have complex integration requirements they want to manage internally.

However, the true cost includes additional services like document management, human bookkeeping support, and ongoing integration maintenance, while users must still handle manual data entry, reconciliation, and supplier communication themselves.

Outmin represents the future of business finance for companies that want results without the work. The AI-native approach automates manual bookkeeping processes that traditional software still requires, providing businesses with daily financial visibility without ongoing management responsibilities.

For companies looking to eliminate bookkeeping overhead while maintaining professional-grade accuracy, this Xero alternative offers a fundamentally different operational model that is clearly superior.

Ready to move beyond manual bookkeeping?

If you’re still deciding between Outmin vs Xero, ask yourself this:

Do I want tools, or do I want outcomes?

Do I want to manage the system, or let the system manage itself?

Do I want to chase documents and fix errors, or focus on higher-value work?

If your answer is the latter, Outmin might just be your next move. Book a demo today and see how intelligent bookkeeping can replace your legacy stack.

Frequently Asked Questions

What is the difference between Outmin and Xero?

Outmin is an AI-native bookkeeping system that automates the work itself. Xero is a cloud-based accounting tool that provides the features to manage bookkeeping manually. With Xero, users need to input data, reconcile bank feeds, and manage integrations. Outmin handles those tasks in the background and delivers reconciled outputs with expert oversight.

Is Outmin better than Xero for small businesses?

It depends on what the business needs. For small businesses that want to manage their own bookkeeping, Xero offers a flexible set of tools. But for businesses that want the work done for them, without managing software, integrations, or document collection, Outmin is a stronger fit. It removes the need for manual bookkeeping entirely and delivers daily financial visibility with minimal effort from the user.

Can Outmin replace Xero and QuickBooks?

Yes. Outmin is designed to fully replace the functionality of Xero/QuickBooks, Dext, and a human bookkeeper combined. It connects to financial data sources directly, automates reconciliation, and delivers real-time reports, without requiring users to operate software or configure tools.

Is Outmin more expensive than Xero?

Outmin typically costs more than Xero’s software subscription alone, but less than Xero plus Dext plus internal or outsourced bookkeeping labour. For many businesses and firms, Outmin delivers significant cost savings by removing the need for multiple tools and reducing time spent on bookkeeping.

Does Outmin integrate with other software?

Outmin does not require third-party integrations. It connects directly to banks, POS systems, payroll feeds, and supplier portals. Users do not need to set up or manage integrations. All data is collected and processed automatically in the background.

Can accounting firms use Outmin alongside Xero?

Yes. Many firms start by using Outmin for specific clients, especially in industries like hospitality or retail. Outmin can replace Xero for those clients or run in parallel during a transition period. Firms retain control over final reporting, VAT submissions, and advisory services.

What industries is Outmin best suited for?

Outmin is especially effective for businesses with high transaction volume and recurring bookkeeping patterns, such as hospitality, retail, and manufacturing. It's also a strong fit for accounting firms looking to scale client capacity without hiring more staff.